Bringing Financial Opportunities

to Everyone

100000+

Satisfied Clients

8500+

Members

2

Award Winner

10

Branches

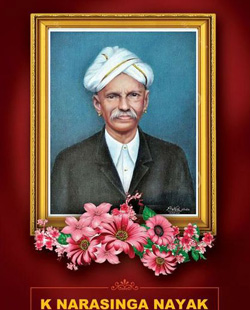

Foundation and Early Years :

The Kasaragod Co-operative Town Bank Limited was established on the 31st of May, 1912. Its journey began under the visionary leadership of its founder president, K. Narasinga Nayak. Initially, the institution started functioning as a society with the primary aim of serving the local community in financial matters. Its head office was set up at Bank Road, Kasaragod, marking the beginning of what would become a significant financial entity in the region.

Registration and Transformation In 1974, after several years of operation as a society, The Kasaragod Co-operative Town Bank Limited officially registered as a bank. It was registered under the Registrar of Cooperative Societies, Kerala, with the registration number 970. This registration marked a pivotal moment in the bank's history, allowing it to expand its services and operate with greater flexibility and scope.

Expansion and Growth :

The bank has grown significantly since its inception, both in terms of its physical presence and its financial services. Currently, The Kasaragod Co-operative Town Bank Limited operates ten branches within Kasaragod District. These branches are strategically located to serve a broad customer base across the district, facilitating easy access to banking services for residents.

The bank has also installed three ATMs at key locations: Bank Road, Vidyanagara, and Kanhangad branches. These ATMs enhance the convenience for customers, allowing for quick and easy access to their funds.

.

Financial Milestones :

As of the latest records, The Kasaragod Co-operative Town Bank Limited boasts a deposit base of Rs. 180 crore and loans & advances amounting to Rs. 122.5 crore. This financial stability is a testament to the trust and confidence that the local community has in the bank.

The bank serves a robust membership base of approximately 18,000 members, reflecting its strong community roots and widespread acceptance. The total share capital of the bank stands at around Rs. 5 crore, underscoring its solid financial foundation.

Current Services and Schemes:

The Kasaragod Co-operative Town Bank Limited offers a variety of financial products tailored to meet the diverse needs of its customers. Some of the latest schemes include:

• Aishwarya Lakshmi and Swarna Lakshmi Gold Loans: These schemes are designed to provide quick and easy loans against gold, catering to those in need of immediate financial assistance.

• Vyapar Dosth Term and Cash Credit Loan for Business: This scheme supports local businesses by providing necessary capital for operations and expansion.

• Sahayaka Mortgage Loan: Aimed at assisting individuals in renovating their existing homes, this loan helps improve living conditions and enhance property value.

• Yuva Home Loan: Targeted at salaried employees and income tax payers, this loan facilitates the purchase of new homes for young professionals.

• Yuva Car Loan: This scheme is designed for the youth, helping them acquire their desired vehicles with ease.

• Merchant Welfare Loan: Tailored for small business owners, this loan supports the growth and sustainability of small enterprises.

• Overdraft Against Deposit: This facility allows customers to avail overdraft services against their deposits, providing flexibility in managing their finances.