These loan products are secured loans where borrowers can pledge their gold ornaments to obtain a loan. The loan amount is typically based on the value of the gold provided as collateral. Gold loans are popular for their quick processing and minimal documentation requirements.

This loan product is designed specifically for businesses to meet their working capital requirements or for longer-term investments. It can be used to manage daily operations, purchase inventory, or invest in business expansion. The loan can be structured as a working capital loan for short-term needs or as a term loan for longer-term financial requirements.

This loan product is aimed at individuals who have a stable income and have filed their income tax returns for the past three years. It is a multipurpose loan that can be used for a variety of personal needs, such as education, medical expenses, or any other personal financial requirements.

Borrowers can avail of this loan by mortgaging their land. The funds obtained from this loan can be used for home repairs, marriage expenses, or other significant personal needs. This loan provides a way for individuals to leverage their property to meet large financial requirements.

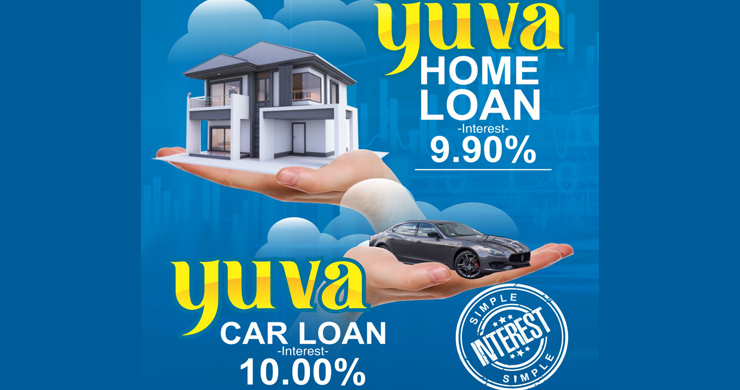

This home loan is targeted at young professionals who have a consistent income and have filed income tax returns. It can be used to purchase a new home or to construct a new house. The loan terms are typically favorable, with competitive interest rates and longer repayment periods.

Similar to the Yuva Home Loan, this product is designed for individuals with a stable income and a track record of filing income tax returns. The loan can be used to finance the purchase of a new or used car. It offers flexible repayment options and competitive interest rates.

This loan product caters to merchants and small business owners. It can be either secured (against collateral) or unsecured (without collateral), depending on the borrower’s requirements and creditworthiness. The funds can be used for business growth, operational expenses, or other business-related needs.

The Mitra Personal Loan is a general-purpose loan that individuals can use for a variety of personal expenses. It does not require any collateral and is based on the borrower’s credit history and income stability. It offers quick disbursement and flexible repayment terms.

This loan product is tailored specifically for farmers and agricultural activities. It can be used for purchasing seeds, fertilizers, equipment, or any other agricultural needs. The loan supports the agricultural sector by providing necessary financial assistance to enhance productivity and sustainability.

Start Building Today

Get in touch to learn how our bankign solution can inrease your business